Accurate

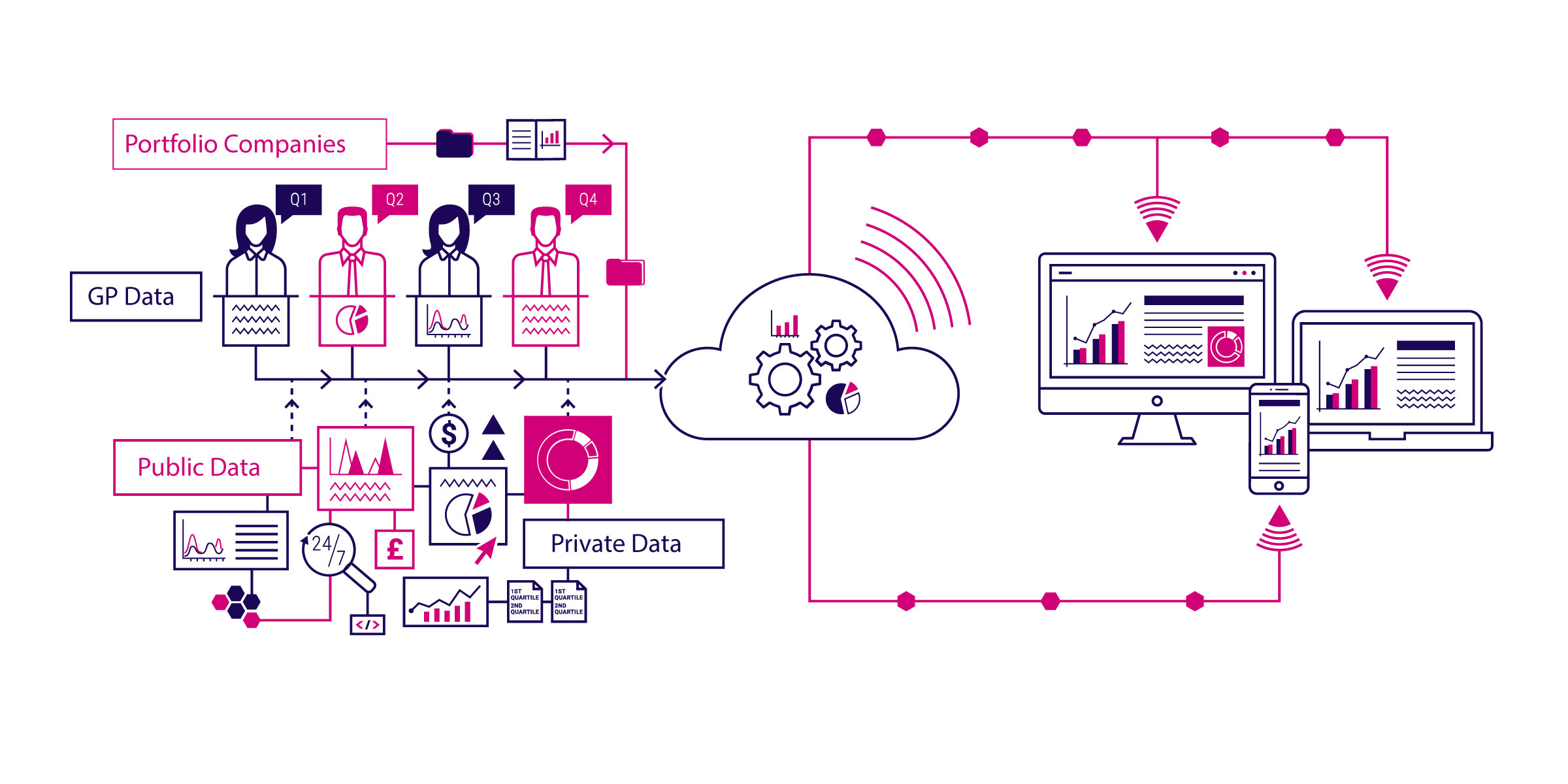

Why is it that an individual investor can get a more insightful and consolidated analysis of their public portfolio than an LP who invests millions of dollars in private assets?

Trust us to manage the collection and extraction of your invested fund and portfolio company information. Our team of former LPs manages your data, so that we can deliver you real time portfolio monitoring and analytics through our award winning technology, HELIOS, giving you greater clarity and control over your investments.

Data

management

Streamline collection

Our team of former LPs use our latest machine learning technology and their years of experience to collect and extract all of your portfolio information, from the invested fund to the underlying assets. Simply ‘cc’ us on your GP communications and we’ll do the rest.

Custom data models

One model does not fit all. From secondary investment cost logic to custom data tagging, we help our clients to define their requirements, so that our team can help empower custom data management solutions.

Deliver at Speed

The world is constantly changing, and so is your data. That is why we deliver it in real time with the industry’s fastest service-level timelines, supercharged by STRIDE.

Quality

service

Consistency

Your data needs to be accurate and high quality. We don’t rely on templates. We dissect every number to ensure that the data is consistent, on a fair-value basis and accurate for the entity you invest through. Everything goes through a 4-eye review. It’s our standard, and should be yours as well.

Correspondence

If we believe a number is missing, or we need an additional breakdown, we communicate directly with the GPs on your behalf. Don’t worry, as a former LP, we know exactly how to manage additional data requests while respecting the strong partnership between LP & GP. It’s a considered approach.

Analysis

Our team can help with qualitative analysis as well, by providing performance narratives, variance analysis and market commentary.

Experienced team,

quality data

Experience the Colmore difference.

See how